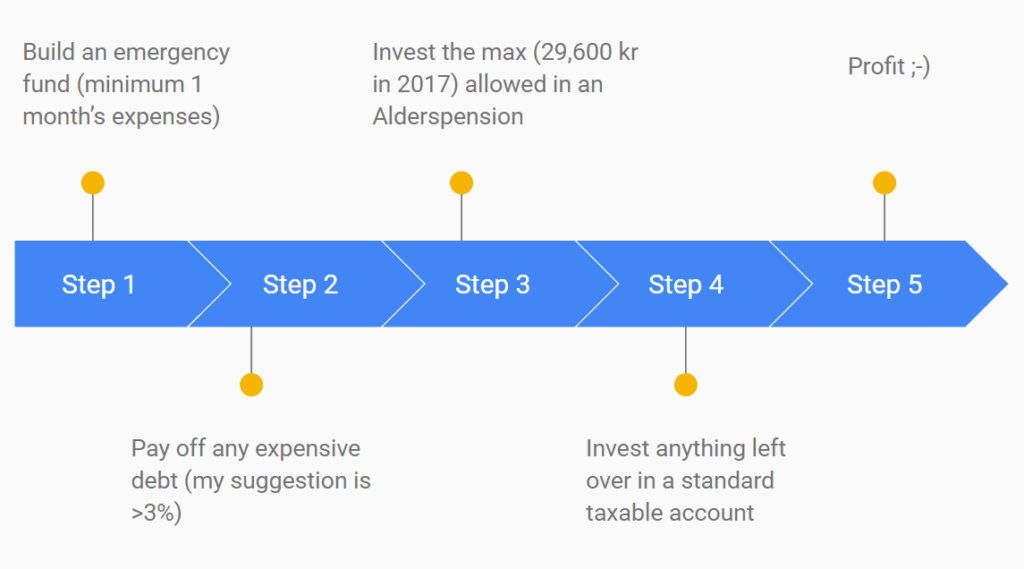

So, this is one of my favorite topics to discuss and there is no one set way to go. Here I outline what I’d probably do and then discuss some other approaches. The general idea is really simple but each step has a lot of nuances:

Financial Independence in Denmark

Tackling Financial Independence in a Danish perspective. Investments, taxes, personal finance and retirement.

Hi all

While I know from myself that it is often tempting to get all information before starting on a new journey there is so much information available that you might never get around to starting. Like I pointed out in my previous post your savings rate is by far the most important metric in determining your time to FIRE. So, in this post I will focus on getting started saving and then my next post will specify what to do with the money you save.

If you read along in my previous posts you’d know that I advocate:

This is very simply put what you need to do. Taking it one step further – in order to maximize progress, you’ll need to:

Continue reading “Why reduced spending is the most significant change you can make”

Just so that we’re all on the same page I’ll write a small introduction to Financial Independence for those that didn’t encounter the term before.

Financial independence: When you live in a way so that you don’t have to go to work to support your lifestyle.

This can be done in a few ways in Denmark:

I started getting interested in personal finance and specifically financial independence about a year ago but have been finding that many principles can be hard to apply in Denmark. Through social media I’ve seen that many others have had the same difficulty in applying FIRE principals in a Danish setting. I sincerely hope that this blog can stir discussion and help others along while I get my own thoughts consolidated into print. So, the triple purpose of this blog is to:

Continue reading “Your new resource for personal finance and financial independence in Denmark”