ÅOP is not good enough!

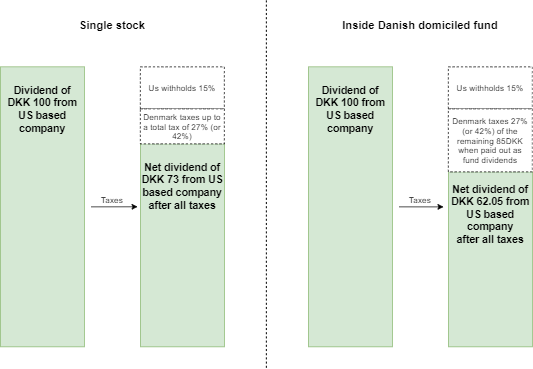

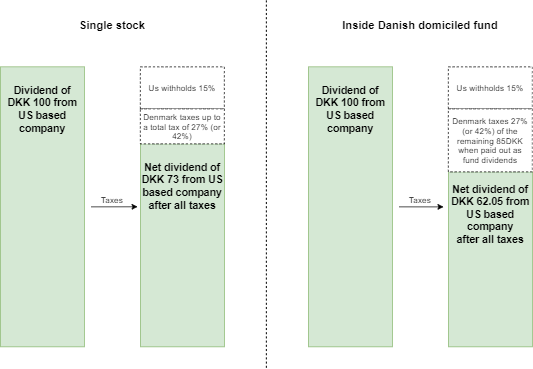

I had written a long paragraph, but I deleted it all cause the point is simple: ÅOP hides the fact that when buying index funds, you are taxed twice on most foreign dividends. To clarify through example:

Tackling Financial Independence in a Danish perspective. Investments, taxes, personal finance and retirement.

I had written a long paragraph, but I deleted it all cause the point is simple: ÅOP hides the fact that when buying index funds, you are taxed twice on most foreign dividends. To clarify through example:

Hi all and thanks for the patience! I’m afraid you’ll have to be patient for just a bit more while I ramble on why I haven’t been rambling. I haven’t blogged for quite a while and as I’ve told everyone who asked there were two major reasons:

Continue reading “Back from hiatus for a short while”I see a lot of people devising strategies around dividends while on the other side of the spectrum some people prefer growth and go out of their way to avoid stocks and funds that pay out high dividends. The allure of dividends (I think) is that you can see cash go into your account – but there are three reasons I don’t like them:

One of the major decisions when investing is whether to invest in retirement accounts or in a standard taxable brokerage account. There are so many factors playing into this that it is impossible for me to consider every imaginable situation so I will try to lay out some of the considerations and then I hope you will add your own thoughts or questions in the comments 🙂 For those of you that just want a quick answer I made this decision cheat sheet:

Fairly simple, right? Continue reading “Should I utilize retirement accounts or go taxable?”

One of the financial questions almost everyone will ask themselves at some point is “should we buy a home or should we rent”. In Denmark, we have a very big societal pressure to buy. If you dare to question the general notion that everyone should buy their own home the answer I hear most often is: “I want to pay off on my house instead of pouring money into the pocket of some landlord”. This is an emotional response rather than a rational so I will try to dig into the math’s instead.

I’ve seen this question a few times recently. It usually goes something like “I can set aside x kr. a month for investments. How many months should I save before I invest it?“. The question makes great sense because if you invest too little and too often the brokerage fees might eat up a relatively large percentage of your investment. What people sometimes forget is that if you save up in a savings account for too long to save on fees you are missing out on potential growth. So here I will try to guide you through the process of answering this question for yourself. It should be noted though that the difference you can make will be relatively minor over a long period of time – the most important thing is to save money and get them invested!

Continue reading “How much money do I need before I can start investing?”

Hi all

While I know from myself that it is often tempting to get all information before starting on a new journey there is so much information available that you might never get around to starting. Like I pointed out in my previous post your savings rate is by far the most important metric in determining your time to FIRE. So, in this post I will focus on getting started saving and then my next post will specify what to do with the money you save.

If you read along in my previous posts you’d know that I advocate:

This is very simply put what you need to do. Taking it one step further – in order to maximize progress, you’ll need to:

Continue reading “Why reduced spending is the most significant change you can make”

Just so that we’re all on the same page I’ll write a small introduction to Financial Independence for those that didn’t encounter the term before.

Financial independence: When you live in a way so that you don’t have to go to work to support your lifestyle.

This can be done in a few ways in Denmark: