Hi all

While I know from myself that it is often tempting to get all information before starting on a new journey there is so much information available that you might never get around to starting. Like I pointed out in my previous post your savings rate is by far the most important metric in determining your time to FIRE. So, in this post I will focus on getting started saving and then my next post will specify what to do with the money you save.

Set up a savings account

First of all, I think you should set up a dedicated account for your savings. You can either contact your current bank and ask them to set up a savings account (they should do this for free but make sure to ask first) or you can go ahead and create an account at Nordnet. You will probably need a Nordnet account anyway at some point since they offer some of the cheapest investment fees on the Danish market. An account is free and easy to set up so if you later decide to do your savings elsewhere you won’t have lost anything.

Get an overview of your current spending

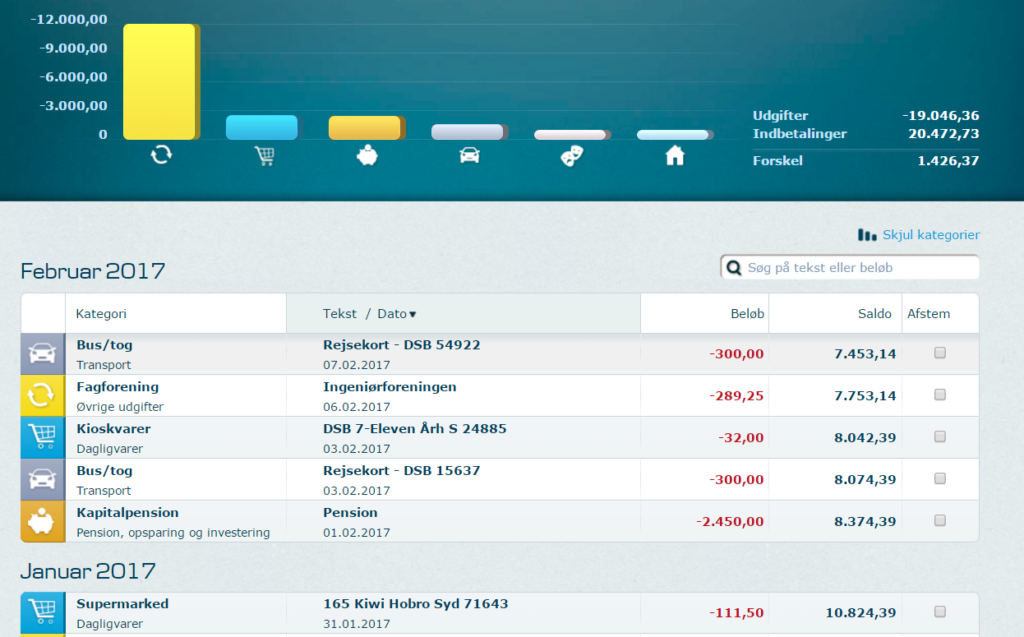

The best way to start cutting expenses is to get an accurate overview of your current spending. You can do this in many ways. In my net banking solution (Danske Bank) I can go through all my transactions and categorize them easily:

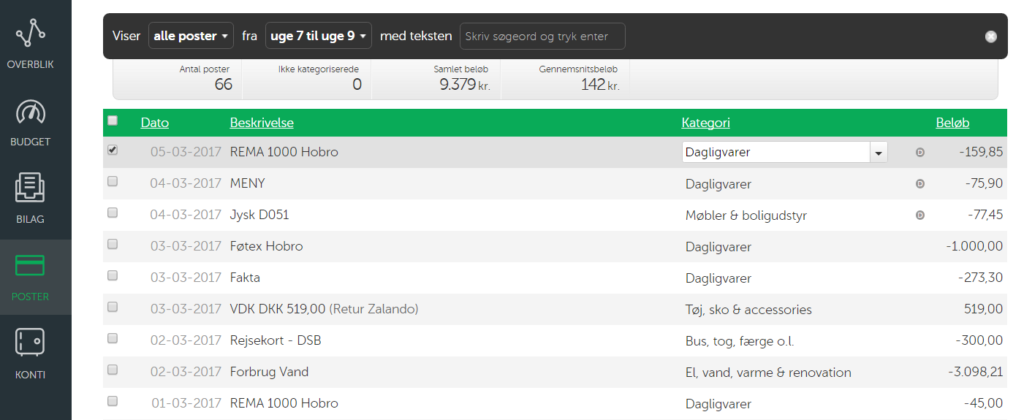

Another option is Spiir.dk. It’s free and easy to use:

Once you know what you are spending you can decide for every category whether or not the expenses are justified by the increase in happiness, comfort or the fulfilment they give you.

What to cut?

Pay special attention to recuring costs. That 30 kr lunch or 20 kr coffee you get daily will pull 4-6000 kr right out of your investment accounts each year. TV-packages, fitness subscriptions etc. are other things you might want to at least consider.

Then there are the subscriptions that might just be too expensive. When did you last check if you could get your cellphone or internet subscriptions cheaper? And what about insurance – there might be a lot to save there. Can you cut any insurance like “accident” or can you switch some or all your insurance to a different provider?. IDA forsikring and Lærernes Brandforsikring are among the cheapest I’ve seen but both have certain requirements to join – just be sure to shop around.

The most drastic but also the most significant ones are probably your car and your home. Those decisions are not to be taking lightly but if you figure you could live in a smaller place or go carless those are probably some of the biggest impacts you can make to your spending.

This was just a short post for today since I really think most people should look this over themselves and try to optimize. There are no optimal general guidelines other than only spend on what you value.

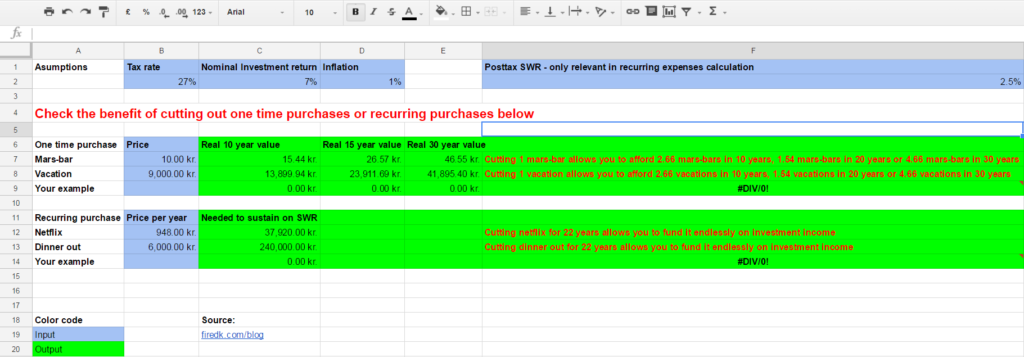

To give a bit of motivation though I threw together a quick spreadsheet to illustrate what you may get by delaying gratification and investing the 5000 kr you were about to use for a TV-upgrade or the 500 kr a month you might be spending eating out:

Hello and thanks for the great blog!

I am currently working in Denmark for an international company since 2016. I don’t have any immigration plans (yet!), but i might spend another few years here as it’s quite nice here for my family while the kids are still small. I have some questions to you regarding investments:

1) Since 2017 i have been investing part of my salary to some investment products in Danske Bank (guided by Danske Bank consultants – not impressed at all!). Now I am looking for lower commissions, and found Nordnet on the internet. Do you recommend Nordent over Danske Bank?

2) I am not EU citizen, so I am not sure what happens to my savings/investments at Nordnet if i decide to leave Denmark and move to US or another EU country. Can I keep my investments in Denmark and sell later (when living abroad)? If not, then what would be the best/optimal strategy?

Thanks in advance!

Kenet

Hi and thanks for the nice words.

Regarding 1), then yeah definitely go with Nordnet or Saxo for investments rather than Danske Bank. I also use Danske Bank for my banking needs, but go with a combination of Nordnet and Saxo for investing. Danske Bank can be fairly competitive on investing if you invest only in their cheapest indexfunds by Danske Invest and set it up right but anything else will incur far too high commisions. Nordnet has månedsopsparing that is cheap for investing a set amount monthly in a set allocation of some select funds (well it’s free for investing, but when at some point you want to sell you’ll be charged). Saxo is just cheap almost no matter what you do at .10% fixed commision with no minimum. With Saxo just make sure to create a currency account if you want to trade stocks in another currency than DKK to get the best rate for that.

Regarding 2), you should definitely talk to an accountant. As far as I know the most straightforward option would be to just sell all your positions and reinvest whereever you go. That would of course incur fees (0.10% + potentially currency spread at Saxo, bit more elsewhere) and taxes on earnings. It might be better to just transfer the actual stocks/assets to avoid the high Danish taxes but to avoid this the Danish state has some laws often referred to as “Havelågeskat” (garden gate tax) that seeks to tax asset earnings at fair value even without a sale in the event of moving out of the country. So as I noted earlier it might be worthwhile to consult an accountant if there is a lot of money involved but otherwise the sell off and rebuy would be easier to handle personally I think.

Best regards

Asbjørn

Asbjørn, thanks a lot for your reply. I found that Saxo is the best for me – they allow to keep my investments in Denmark, even i permananently leave to my home country (outside of EU).

Hi!

First of all, thanks a lot for writing all this information on your blog, and thanks for doing so in English!

Another foreigner (from Holland) here who is interested in starting investing his savings, and your blog is a great source of information. (I”m a total beginner in terms of investing)

I am thinking about opening an account at Nordnet and carefully start buying some stocks that I find interesting to start with (and begin with a small amount).

– One thing I was wondering in relation to paying tax when stock trading:

So as far as I understand, here in Denmark we pay 27% for the first 51700 kr (in 2017) you make in profit in a given year and then 42% for anything above that limit. But you only pay this tax if you decide to sell your stocks, right? If I decide to not sell my stocks, I dont pay any tax on the “unrealized” profits?

– And what about if I sell some of my stocks, can I keep the money from selling the stocks in my Nordnet account, so I can use it to re-invest in other stocks without having to pay tax on the profit before I re-invest it?

– Do you know how it works in terms of notifying Skat about stock profits? Do I need to fill in a form to let Skat know about my profits? And do I need to notify Skat every single time I sell some stocks? Do you have any more information on how to file taxes when trading stocks here in Denmark?

– And finally: I read in one of your articles that with Nordnet, you don”t pay a fee when buying/selling stocks. Did I understand this correctly, and can I buy any stocks without paying a fee, or only certain stocks?

Thanks again for providing all this great information, I really enjoy reading all your posts here 🙂

Best regards,

Bram

One more question just came to mind:

Do you know if income from selling stocks impacts the total tax one would pay on their salary income for example?

Let”s say that I make 400.000 DKK per year in salary, and another 50.000 DKK in stock profits, would my total tax-expenses then go up due to a larger total-income? Or would I pay seperate tax on the 50.000DKK from stock profits alone (seperate from my salary-income tax).

Best,

Bram

Stock profits are separate from income tax. Though if you buy some international ETF’s, bonds, accumulating funds or get interest in a high yield savings account that is considered capital gains and is taxed differently and more in line with income tax – specifically if you lose money on an accumulating fund you can get a tax deduction that can actually save you on your income tax.

Hi and thanks for the kind words.

To answer your questions first note that all the rules you mention are regarding ordinary brokerage accounts – there are options for tax advantaged accounts too and those follow different tax rules.

– You are right in the first point – you only pay tax if you sell your stocks or if they pay dividends. Total profits from sales and dividends (subtracted any realized loses) each year are taxed at the 27/42% tax. The progression limit is 54,000 kr for 2019.

– Keeping the money in the brokerage account doesn’t avoid taxes. The moment you sell you incur the tax.

– If you trade through Nordnet, Saxo or one of the banks they will report everything to Skat. When you receive your yearly statement (“årsopgørelsen”) from Skat just glance it over and see if anything is clearly out of whack. If it is you can submit your own corrections but generally it should be automatic. If you trade through Degiro instead you’ll have to report everything manually so not many Danes do even though they can be competitive on pricing.

– With Nordnet you generally pay 0.10% on stock trades but with a minimum of 29kr. Saxo is a bit cheaper for small trades since they also pay 0.10% but have no minimum. On the other hand Nordnet has something called “Månedsopsparing” where you pick a few funds from a select list, choose the allocation and then once a month it buys that allocation with no fees if you have funds in the account. It’s simple and nice for dollar cost averaging and having it all on autopilot so a lot of Danes use it. You will still be charged a fee when selling and you are also fairly limited in which funds you can choose so personally I just invest at Saxo. If you buy and hold for long those small fees are not the end of the world.

Other than that there are ofc. more complexities. Employee stocks, unregulated stocks, stocks purchased before 2006 etc. etc. has slightly different rules. Also there are taxadvantaged accounts that could potentially be worth it for small time investors (like myself) – I just bought into “aktiesparekontoen”, I have “aldersopsparing” too and then there are options like “børneopsparing” and different retirement accounts.

I have to run but feel free to ask more 🙂

Thank you very much for the detailed reply!

Very informative 🙂

Hi,

Thanks for writing this great post. I would like to know more about spiir.dk. Can you by any chance make a detailed review of the app and share with us what are goods and bads for it and what are the limitations?

Thanks!

Thanks for the attention. I’d love to do that as soon as I get time. I have some other posts planned but will try to get it done this Saturday if I can find the time 🙂

For now, I can say that I really enjoyed to use it to review the past 2 years spending. It’s very simple and can auto categorize a lot of stuff. I use it across 2 of my own accounts and my girlfriends and it automatically finds account transfers and excludes them. The reports are not that customizable but gives a good overview of where your money is going and how different categories of spending change over time. I don’t use it daily but once every 2-3 months I open it and categorize the expenses it couldn’t automatically assign and check if anything is out of whack or needs my attention. The best benefit has been that it helped my girlfriend realize the extent of renovations on the house 😉